Test your deal evaluating skills?

Every successful investor balances the risks with the benefits. Let’s test your insights with this Example:

You find a single family house and after talking to the seller you find out:

Fair market value $180,000

Seller Owes $135,000

Seller in arrears $ 1,800

Estimated Repairs $ 5,000

Seller’s Monthly pmts $ 1,003 per mo (7.75% interest rate)

In your market, you estimate it will take about 3 months to get a tenant-buyer that will pay the market rate of $1350 per month.

Is this a good deal?

Let’s do the Math. Let’s review the numbers below and then break it down.

Well, there’s $38,000 in equity even after fix-up and payoff off the arrearage. Let’s calculate the cashflow: (you can get out your calculator or use my Deal Evaluation Tool).

|

Monthly

|

| Rent Income |

1,350.00

|

| Other Income |

|

| Vacancy Adjustment |

|

| Gross Operating Income |

1,350.00

|

| Expenses |

211.00

|

| Loan Payments |

1,003.00

|

|

|

| Net Operating Income (NOI) |

1,139.00

|

| Net Cashflow |

136.00

|

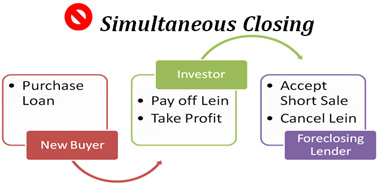

The cashflow appears to be decent, and the equity is nice. Just lease option it for a year, and then get the tenant to refinance.

What’s the Catch?

I know a lot of investors that would take this deal. (At one time, we would have). However, let’s remember that 3 month holding period. During that period you’re paying the mortgage, taxes and insurance, plus some utility costs. All told that’s going to run about $4,060.

Oh, and the repairs…no repair job no matter how small costs what you think it does—it’s always more. That $5000 could easily grow to $7000. That means you’re going to have to come up with $11,000 before you receive a penny from a tenant.

Risk #1 = $11,000 in carrying/purchase costs. Where are you going to get the money?

The Cash Crunch

Remember—never use your own money. If you can’t borrow it or negotiate it, I strongly recommend you walk away.

But suppose you had a friend that would lend you the money (at 12% interest). Ok, but that’s $110/month added to your costs. Now, your cashflow is down to $26 per month. That’s pretty slim, but positive. As long as nothing goes wrong.

However, this raises a big red flag in the Deal Evaluation Tool. Why? Because what if your tenant stops paying. Well, even if you had a hungry buyer lined up, and lived in a state that made evictions quick, like Georgia, you’d be sucking air for at least 2 months.

Risk #2 – But heck, even if you lost only 1 month’s income, you’d be negative for the entire year.

Bottom-line – Bad deal – walk away. There are better deals out there. Don’t tie up your resources and stress yourself out for a hoped for pot of gold at the end of the rainbow—you may not get there.

The Deal Evaluation Tool to the Rescue

These are the kind of situations, I coach my students to analyze before they act. A bit of due diligence, and the use of my Expert System–the Deal Evaluation Tool, could have allowed any investor to walk away from financially dangerous situations without costing him a dime. It also calculates your costs, income and tells you if the risk is too great. It will even let you test out different strategies or what if a scenario to find which one works best. We use it for all our deals. I insist my students use it, and I highly recommend it to you.

This is a system with my built-in expertise that has helped us tremendously in sorting through the points I’ve discussed above, for just about any kind of deal from single family to multi-family, rehabs to rentals, and short sales to pre-construction. Put in a few simple numbers that you can get from the seller and a bit of due diligence, hit the enter key, and voila: You get a complete report of your cashflow, profit and risks for up to 10 years into the future.

It will also tell you whether the deal is a go or no-go. If it’s a no-go, you’ll also get specific suggestions on how to fix it, based on the risks involved. And importantly, you’ll be able to work out a return for your investors that will make them salivate and bring you a hefty return.

I developed this tool for our own real estate business and it has consistently steered us away from bad deals and identified the slam dunk ones. We use it on every deal we do.

For InvestorWealth subscribers, we sell this Deal Evaluation system for $297, and that’s a great deal. Now, because you are an Investor Wealth-Network Member, I am going to give you this incredible Expert system for only $147 – that’s a 50% discount—You Save $150. Just click this link

If you don’t use this tool before you do a deal, you are putting yourself, in my opinion, at an unacceptable risk. If you want to do only successful deals and completely eliminate losers, getting the Deal Evaluation tool is really a no-brainer.

P.S. There are a couple of other ways to work this deal that could turn out better. Can you think of any? Just put your comments in the forum.

Test your deal evaluating skills?

Test your deal evaluating skills?