|

|

|---|

With so many homes going into foreclosure, or already taken back by a lender, Real Estate Investors have the opportunity of a lifetime to make huge profits by negotiating

- 1) short sales with lenders who foreclosing on homes

- 2) big discounts on bank-owned inventory (REO’s)

and then reselling them to a new buyer at a higher price thus making a profit while still offering the new buyer a great discount.

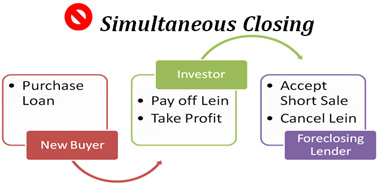

In the past, these types of flips could be accomplished in a simultaneous closing such that the investor closes with the buyer, and simultaneously uses those funds to pay off the lender at the negotiated price and pocketing the difference as his profit.

Net net this is a nothing down transaction because the investor is using the buyer’s funds to pay the lender.

Unfortunately, this is no longer legal and will not be permitted by the lender, and closing attorneys will not do it.

Instead, there needs to be 2 transactions:

- 1) “A to B” closing in which the investor (B) pays the lender (A), and gets title to the property and the lender cancels the lien.

“B to C” closing in which the investor (B) sells the property to a new buyer (C) and takes his profit

Now, clearly the problem with this new “double closing” is that the investor has to come up with All the Funds to pay the lender before the property can be sold to the new buyer. However the investor only needs those funds for less than a day!

Where to get the money? There are now “Transactional” lenders that will lend money for these types of transactions.

Since all parties need to be lined up including the lender doing the short sale, the new buyer, the title company, the new buyer’s funding source, there are lot’ s of things that could potentially go wrong at the last minute. Therefore, you need to choose a transactional lender that will actively work with you to take care of any hiccups along the way.

In this article we tell you what you need to do to get these funds and which source to choose to fund your transaction. And as a member of the Investor Wealth Network we give you access to a transactional lender that fulfills these criteria.

To Apply for transactional funding, here’s what you have to do:

- 1) Line up a buyer

- 2) Get the buyer qualified (not pre-qualified). Qualified means the underwriting of the borrower’s loan request has been approved.

- 3) Get together all the documents you need. (use the link below to get to the form)

- 4) You can start negotiating the short sale. However, the most important part of this process is getting a buyer ready to buy.

- 5) I know, you’re probably asking how can you get a buyer if you don’t know how low you can get the short sale? The answer is, you make your bottom line before you start negotiating the short sale. If you don’t get it, go on to the next property.

So, where do you get the money? There are 2 sources:

1) Coastal Funding – http://coastal-funding.com

They will provide a proof of funds letter to anyone – just fill out the form on their website, and press download. So, if you just need a proof of funds this is the place to get it.

Their fee structure is:

There is another source with a little bit lower processing fee ($495). See below.

View this video from my colleague Jason, follow the steps above and then apply for funding .