Angel Investors or “Business Angels” are high net worth individuals who invest in start up companies in exchange for an equity stake in the company. These individuals are usually successful entrepreneurs in their own right who have built great wealth from their business(es) and may have sold them and have large amounts of cash.

They prefer to use a significant amount of that capital to invest in start-up companies and other alternative investments that will yield a high rate of return. They are comfortable with the risk a new venture may present, as long as it’s a calculated risk.

In a recent survey, these angel investors and venture capitalists were asked to rank the most important factors when valuing a company prior to investment. The factors were ranked on a scale of 1 to 7 with 1 being the most important. (see the chart below).

I am going to describe how you can use this information to present your business or your real estate deal as an attractive opportunity to an angel investor.

|

Angel

Investors |

|

Venture

Capitalists |

|

| Factors |

Points |

Rank |

Points |

Rank |

Quality

Management |

7.1 |

1 |

5.4 |

1 |

Growth

Potential |

4.7 |

2 |

4.2 |

4 |

Proprietary

Product |

4.4 |

3 |

4.4 |

3 |

Market

Size |

4.3 |

4 |

4.6 |

2 |

Barriers

to Entry |

4.2 |

5 |

4.1 |

7 |

| Competition |

4 |

6 |

4.2 |

4 |

Return

on Investment |

3.9 |

7 |

4.2 |

4 |

Table

1: How Angel Investors and Venture Capitalists Value Potential Companies

Taken from Brian E. Hill and Dee Powers’ Attracting Capital from Angels: How Their Money and Their Experience Can Help You Build a Successful Company, 2002.

In this article I will focus on Angel Investors, because they are a potential source of funds for both start up companies and real estate deals. [Venture Capitalists are not interested in real estate since they require at least a 10 fold return on their money, and real estate does not fit their investment model].

Quality Management

As you can see from the chart, the most important decision making factor for Angel Investors is the Quality of the Management Team. The angel investor wants to know:

1. Do you know what you are doing

2. Do you have experience in the investment area

3. Have you had previous successes

4. Do you have a business with a strong TEAM of experienced, knowledgeable

and successful individuals?

5. Does your team cover all the areas of expertise needed to make the venture

successful.

Most real estate investors start out as individual entrepreneurs. However, if you want to raise money from sophisticated private investors, you have to develop a real company with a team of individuals who can complement and supplement your experience and expertise. And if you currently have little experience, building a team is a prerequisite to your funding success.

And by the way, creating a successful business model will be a powerful factor in convincing even friends and family to invest with you.

You are also going to need a good and comprehensive business plan. I can practically guarantee you that no sophisticated investor is going to make a decision to invest without carefully studying your business plan. [If you need help in creating your business plan, see the Resources section].

[PART 2 – WITH CHART AND INTRO]

[NOTE: DET REFERENCE WILL BE REPLACED BY THE RISK ANALYSIS PROGRAM WHEN IT’S READY]

Growth Potential

For a start up business, growth potential refers to how big and profitable the company can get. In the area of real estate where the investment is usually focused on acquisition of a particular property, the investor will want to know the exit strategy and profit margin. What kind of profit is possible (and reasonable) from the investment, and how and when can you exit from the investment and pay off the investor.

Doing this type of analysis can get complicated especially if the investment will be over a period of years. If you need help, you should get the Deal Evaluation Tool that will help you formulate your exit strategy, project all the financial factors up to 10 years in the future, and calculate the risk and return for your investors.

The investor will also want to see your projections of the market you are buying in. Is your market appreciating, depreciating or steady? How can you turn this to your advantage? What does your demographic research indicate about the availability of buyers or tenants? You must have solid facts to back up your analysis.

Proprietary Product

For a start-up company, a proprietary product is essential, because it gives the company intellectual property rights over the invention. In real estate ownership rights are conferred when the property is purchased.

However, the investor is very interested in the uniqueness and benefits of your acquisition, management and exit plan. How does your plan insure your success under today’s market conditions? How does it address the risks inherent in any real estate investment?

Another consideration is how you can distinguish yourself from all the other real estate investment opportunities that come across the Angel Investor’s desk—and believe me, there are many.

In the Private Lending Insider you are fortunate to have access to 2 tools that will give you a unique advantage over other real estate investors, and make your offering a lot more memorable in the minds of Angel Investors. I know because I’ve tested this myself.

The first tool is the DealEvaluationTool (DET). The unique advantage you can emphasis with the DET is not only its powerful ability to calculate and project financials, but its ability to Quantify Risk. And it’s ability to evaluate alternate scenarios and strategies to minimize risk to the investor while maximizing profit! This is a really strong selling point since it addresses 2 key concerns: the return OF investment, and the risks to profit.

The second powerful weapon that gives you a unique advantage is the Joint Venture Facilitation Package . It has the ability to create a daily, up-to-the-moment current list of motivated sellers and buyers, and do it before anyone else knows about them. This can give your investor more confidence that you can find the best deals, and have a list of buyers to take them out of the investment.

If you are serious about creating an attractive and winning presentation for private lenders I highly recommend you to take advantage of your membership discounts and get both of these tools.

[PART 3 – WITH CHART AND INTRO]

[NOTE: NOT SURE WHAT SECTION THE DET IS IN]

Market Size

For start up companies, market size is important because it sets an upper limit on how profitable a company can be. For real estate, the equivalent question would be what the ultimate value of the property will be when it is sold. If your investors are taking an equity stake in your project, the size of the profit and the safety of the profit is their paramount concern.

You must have the research on all the factors affecting the valuation of the property, and the projection of those factors to the time of sale. Again, the Deal Evaluation Tool (see RESOURCES) can be powerful help in making your case.

Barriers to Entry

This concern focuses on what does the company need to accomplish before in can successfully start making a profit. For real estate investments this could include:

1. Money – acquisition, rehab, carrying costs, etc.

2. Financing – if institutional or other financing is needed

3. Renovation – costs, completion time, etc.

4. Leasing or Sales team

5. Contracts with service providers

These should be addressed in the business plan. In fact, the answer to these questions should be the basis for planning any acquisition. And it also emphasizes that you should put together a professional team with expertise in all these areas. Professional Investors regard a “lone wolf” as a liability, no matter how much skill and experience you have personally.

Competition

Competition comes from other business entities that are selling a similar product or service to yours. For example, if you are selling single family homes, your competition comes from other homes like yours that are on the market. When there is a high supply and lower demand, what is your strategy that will give your property a significant advantage over similar properties on the market:

- Price?

- Terms?

- Amenities?

- Location?

- A ready and willing list of qualified buyers?

- Etc.

A Private Lender must know and be comfortable with your answer to these questions. Ultimately, if you can’t “beat the competition”, your investor faces a big loss on his investment. So, make sure your exit strategy is bullet-proof.

[PART 4 With Intro]

[NOTE – there could be a reference here to my new risk evaluation tool, ALSO reference to upper level mentoring program]

Return On Investment

There a rule of thumb that some Angel investors subscribe to that says a good return is seven on seven—that is a 7 fold return in 7 years. That amounts to a 32% annualized return. That’s a pretty high return for a real estate investment.

There are two ways to address this:

- Create a financing plan to generate that kind of return

- Mitigate the risk so that a lower return is more acceptable

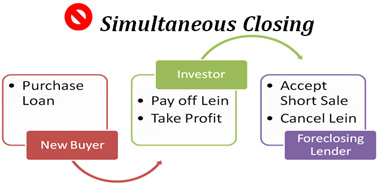

For the first, you could use leveraged funding where the majority of the acquisition cost comes from institutional financing and other sources, so the investor is only putting up a fraction of the cost, and still reaping a significant percent of the profit.

However, realize that with this kind of leveraged financing you are dramatically increasing the risk. For one, if the investment goes south and your financing institution forecloses, your investors face the possibility of a total loss. Also, you introduce an additional risk that if the cash flow is ever not adequate, you may default on your note.

Another simple way to increase ROI (if your deal structure allows it) is to reduce the exit strategy to less than a year. For example, paying 15% on a rehab that pays off in 6 months can generate an annualized 30% ROI.

The second strategy of reducing the risk might include having the investment secured by equity in the property-with your investors in first position. You can also reduce risk by selecting markets and properties that inherently have less risk exposure and putting in place tactics and procedures to address potential risks that may arise.

Another risk reducing strategy would be to have a buyer (with cash or approved financing) lined up for the property before you purchase (e.g., a flip).

The Jockey, Not the Horse

There is a saying in the Angel world: “Bet on the Jockey, not the Horse”. Angel investors take a personal interest in their investments, and they are going to want to meet the management of the company, before they make a decision (Key Secret #5 – Trust).

Therefore to be successful, you must plan to meet your investor prospects and make a convincing presentation of your plan and your business.

If this is an area, you need help with, I strongly recommend you attend our [UPPER LEVEL PRIVATE MENTORING PROGRAM] where we cover all these topics, and much, much, more…

With high net worth individuals you aren’t the first or only investment they’re considering, so wouldn’t it be critical to immediately convince the investor of the value of what you’re doing? The best way to do that is tell them a story about the reason why of your investment.

With high net worth individuals you aren’t the first or only investment they’re considering, so wouldn’t it be critical to immediately convince the investor of the value of what you’re doing? The best way to do that is tell them a story about the reason why of your investment.

Test your deal evaluating skills?

Test your deal evaluating skills?